Access to 26 countries In EU & Visa Free Travel to 183 countries

Affordable investment: Start from EUR 280,000

European passport for the entire family

Safest Country in Europe, top 5 worlwide

10 years non-habitual resident with no tax

Short Stay Requirements

Benefits of the Portugal Golden Residence Permit Program

- Visa-free travel in Europe’s Schengen Area and the right to live, work and study in Portugal.

- Eligibility to apply for citizenship after five years as a legal resident while keeping other citizenship(s).

- One of the cheapest Golden Visa in the world.

- Great exchange rate vs EUR, which means that this is the best time to invest in Europe.

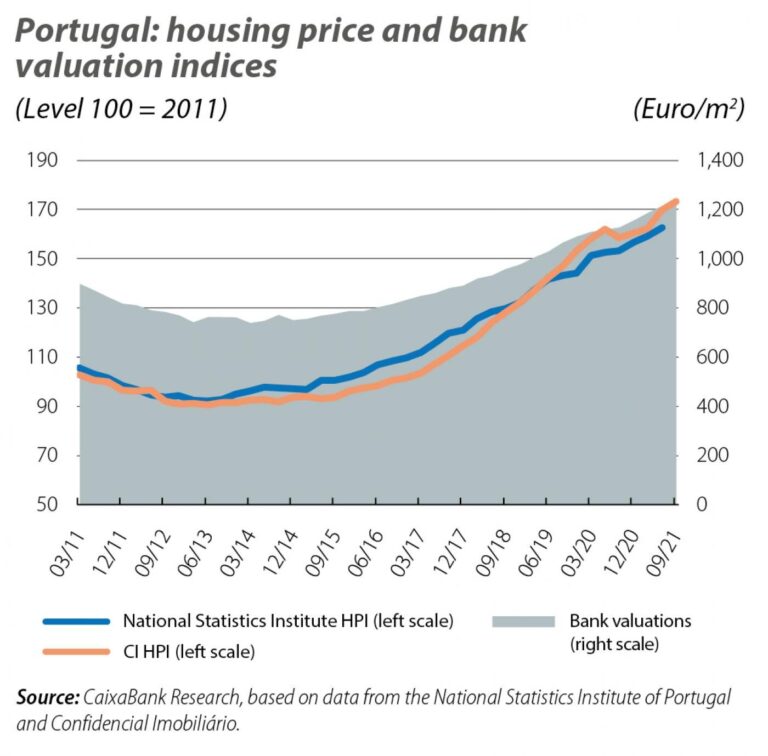

- Great Investment: best real estate market in Europe at the moment.

- Low physical presence requirement (7 days a year or 14 days every two years).

- Considered as top 5 best passports in the world: grant access to 187 countries without a visa, including the USA, Canada, the UK, and Australia.

- International quality healthcare clinics and hospitals.

- Top 5 safest countries in the world, 1st safest country in Europe.

- High quality of life, local cuisine, and wines, rich culture, mild climate with 310 sunny days per year in average.

- Investors can get a special Non-habitual Resident (NHR) status in Portugal for 10 years.

Portugal Golden Visa

Short stay

Spend only 14 days in Portugal every 2 years (or 7 days per year)

Family reunification

Include spouse, dependent children and senior parents under your investment

Multiple investment options and low thresholds

Several investment options, namely in private equity funds or properties

Visa free travel in EU Schengen countries

Visa free travel to more than 183 countries worldwide

Portuguese passport ranks Top 5 on the global mobility spectrum

Access to public service

Such as health care and education

5 years to citizenship or permanent residence

After 5 years of Golden Visa, you can apply for permanent residence permit or citizenship

Safest country in Europe

Top 5 worlwide

Favourable tax regime

NHR tax regime allows a 20% tax rate or total tax exclusion on income for the first 10 years, if you choose to live in Portugal 183+ days per year

TAX BENEFITS

NHR Tax regime: a tax system that allows total exclusion or up to 20% tax rate on the taxation of income for the first 10 years for expats who choose to live in Portugal 183+ days per year.

The Portuguese system has focused on the creation of tax benefits, the strengthening of legal mechanisms to eliminate international double taxation, and the establishment of certain periods for the reporting of tax losses.